THE VAGABOND EFFECT

To demonstrate the importance of property tax assessments to the economic feasibility of historically rehabilitated properties, The Vagabond Hotel was chosen as a reference case study. Property owners and developers take risk when investing in transitioning neighborhoods, often composed of historic resources declining further into neglect while waiting for significant expenditures. Impact investments in historic resources benefit the general public and should therefore seek to unburden current and potential owners. Though incentives such as Ad Valorem tax exemptions and Transfer of Development Rights (TDRs) assist property owners to alleviate the burden of costly historic rehabilitations, the increased property value that historic resources bring to regenerate neighborhoods can be construed as a disincentive for preservation, as their assessed property taxes increase.

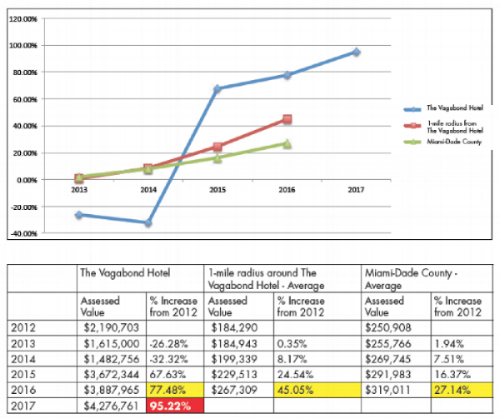

In the case of The Vagabond Hotel, the assessed property value has increased 95% from 2012 to 2017, more than double the averages throughout Miami-Dade County. Though the property has qualified for both Part I and Part II Ad Valorem benefits from the City and County, the total reduction through its effective 10-year period, 2015-2025, will only cover $22,000 per year, or $220,000 total. This is only 4% of the over $5 million spent on the historic rehabilitation. Though it is a worthwhile incentive to reduce rehabilitation expenditures, the overall improvements astronomically influence the increase in property value, resulting in higher taxation.

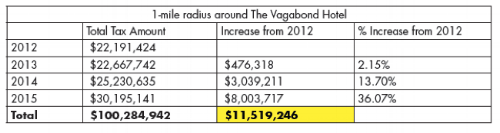

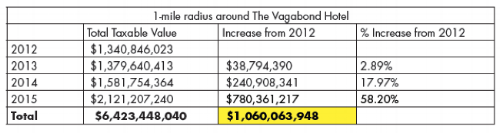

Acting as a catalyst for reinvestment, an analysis of a one-mile radius with the epicenter at The Vagabond Hotel demonstrated an aggregated increase of over $11 million in total tax revenue, increasing taxable property values by over $1 billion in years 2013, 2014, and 2015. This report details the argument to be made for reducing assessed property values of historic properties as an incentive to spur impact investment in Miami’s significant neighborhoods.

This report details the argument to be made for reducing assessed property values of historic properties as an incentive to spur impact investment in Miami’s significant neighborhoods.

FINDINGS

On average, the assessed value of properties in Miami-Dade County increased 27% from 2012-2016.* A one-mile radius of properties around The Vagabond Hotel found the assessed values increased 45% in the same time period. (See Appendix A)

*The 1-mile radius around The Vagabond Hotel totaled 6,410 properties (2012), 6,418 (2013), 6,457 (2014), 6,480 (2015), and 6,485 (2016). Due to the size of the City of Miami, the total property number fluctuated: 122,510 (2012), 123,479 (2013), 125,400 (2014), 128,941 (2015), 131,070 (2016). The taxable value is the end result of market value minus the homestead cap, non-homestead cap, portability and any exemptions. Properties often have more than one taxable value because certain exemptions and cap limitations do not apply to all taxing authorities.

Miami-Dade County

The average assessed value increased from $250,908 to $319,011 over the five-year timeframe (27.1%). The average market value increased from $273,543 to $402,220 over the five-year timeframe (47%). The total taxable value increased from $237,338,068,882 to $361,466,414,992- a $124,128,346,110 increase (52.3%). From 2012-2015, the total tax amount increased from $3,575,050,659 to $4,467,288,054- a $892,237,395 increase (24.9%).

1-mile radius around The Vagabond Hotel

The average assessed value increased from $184,290 to $267,309 over the five-year timeframe (45%). The average market value increased from $209,180 to $388,393 over the five-year timeframe (85.6%). The total taxable value increased from $1,340,846,023 to $2,518,727,758- a $1,177,881,735 increase (87.8%%). From 2012-2015, the total tax amount increased from $22,191,424 to $30,195,141-- a $8,003,717 increase (36%).

The Vagabond Hotel Property Tax Assessments/Revenue Implications

The Vagabond Hotel was purchased in 2012 for $1,900,000. In 2012, the property had an assessed value of $2,190,703. In 2013, the assessed value decreased to $1,615,000 (-26.2% from 2012). In 2014, the assessed value decreased to $1,482,756 (-32.3% from 2012). By 2015, the assessed value of the property increased to $3,672,344 (67.6% from 2012). By 2016, the assessed value increased to $3,887,965 (77.4% from 2012). By 2017, the assessed value increased to $4,276,761 (95.2% from 2012).

The value of the improvements to the property during the historic rehabilitation, as determined by the Property Appraiser, totaled $1,803,871. This historic preservation exemption through Ad Valorem benefits will remain the same for a 10-year period, and will expire in 2025. At the 2015 millage rate, the total property taxes are $40,109. After applying for Part I and Part II Ad Valorem exemptions from the City and County, the reduction totals $22,211 for a total payment of $17,898. This will average $220,000 in savings over the 10-year period.

COMPARATIVE ANALYSIS

In order to analyze the impact of one historic property on the increased tax revenue to the City of Miami, three parameters were established: a historic property- The Vagabond Hotel; a catchement area- a one-mile radius with The Vagabond Hotel at the epicenter, averaged; and the overall- Miami- Dade County, averaged. This illuminated assessed values and percentage increases from the base year of 2012, when The Vagabond Hotel gained new ownership, to 2016. As 2017 information becomes available, this report will be updated.

Comparative Analysis: Assessed Property Values

COMPARATIVE ANALYSIS: TAX REVENUE

When analyzing a one-mile radius around The Vagabond Hotel, the aggregate tax revenue increase from 2012 to 2015 (using 2012 as the base year) totaled an additional $11,519,246 ($36.07% increase). This increased taxable values by an aggregated $1,060,063,948 (58.2% increase) in the three years analyzed since 2012. As 2016 information becomes available, this report will be updated.

Comparative Analysis: Tax Revenue Increases (2012 base year)

Comparative Analysis: Total Taxable Value Increases (2012 base year)

Data sources:Miami-Dade County Open Data for 2012, 2013, 2014, 2015, 2016 (Gridics), Miami-Dade County Property Appraiser Property Record Cards

RECOMMENDATIONS

As stated in Chapter 23 of the City Code of the City of Miami, the City “recognizes that the rehabilitation and maintenance expenses of historic properties can be BURDENSOME...” and need to “provide an INCENTIVE for the designation of historic resources.” Though the Ad Valorem reductions assist historic property owners who undergo significant historic rehabilitation work, property values continue to rise, negating this incentive. Historic preservation is acknowledged to provide a “STIMULUS TO THE ECONOMY” and “FOSTER CIVIC PRIDE,” yet the increased assessed property values further burdens the property owner as their property taxes increase (Ch.23, Article 1, City Code of the City of Miami).

In the case of The Vagabond Hotel, it is clear that the rehabilitation efforts acted as a catalyst to the once-neglected MiMo/Biscayne Commercial Corridor and surrounding residential neighborhoods which contributed to an increase of 45% to assessed property values. This resulted in an aggregate tax value increase of over $1 billion from 2012 through 2015, among other intangible benefits. Yet, in the year 2016, The Vagabond Hotel’s assessed property value increased 77% from 2012, while the 1-mile radius surrounding The Vagabond Hotel increased 45% from 2012, and Miami-Dade County increased 27% from 2012.

Recently, the State of Florida approved a 50% historic property tax assessment reduction (Section 196.1961, Florida Statutes) for designated historic resources.** Due to this legislation, Miami-Dade County instituted a 25% historic property tax assessment reduction, and the City of Miami has yet to provide any historic property tax assessment reduction.

Our recommendation would be to pursue a freeze on the assessed property value for a 10-year period. The incentive would reward property owners who take on expensive, burdensome historic rehabilitations, while providing a stimulus to the surrounding neighborhood and economy. Statuatory precedents can be found in the states of Georgia, Illinois, Louisiana, and Oregon.

Findings from the 2012 Economic Impacts of Historic Preservation in Florida report demonstrate the effectiveness of historic preservation to create local jobs (111,509 jobs in Florida, 2007-08), contribute to local, state, and federal tax collection (estimated $1.38 billion in Florida, 2007-08), supply an estimated $2.03 billion on the rehabilitation of historic property from 2003-08, and entice heritage tourists who spent an estimated $4.13 billion in Florida in 2007. These activities had a total in-state impact of $6.6 billion in direct annual investment. Through diverse economic benefits, a 10-year assessed property value freeze seems an adequate incentive for reinvestment in Miami’s historic neighborhoods.

**The statutory criteria include: (a) The property must be used for commercial purposes or used by a not-for-profit organization under Section 501(c)(3) or (6) of the Internal Revenue Code of 1986; (b) The property must be listed in the National Register of Historic Places, as defined in Section 267.021; or must be a contributing property to a National Register Historic District; or must be designated as a historic property or as a contributing property to a historic district, under the terms of a local preservation ordinance; and (c) The property must be regularly open to the public.

Research and analysis: Laura Weinstein-Berman (updated December 12, 2017)

Written and researched by Laura Weinstein-Berman